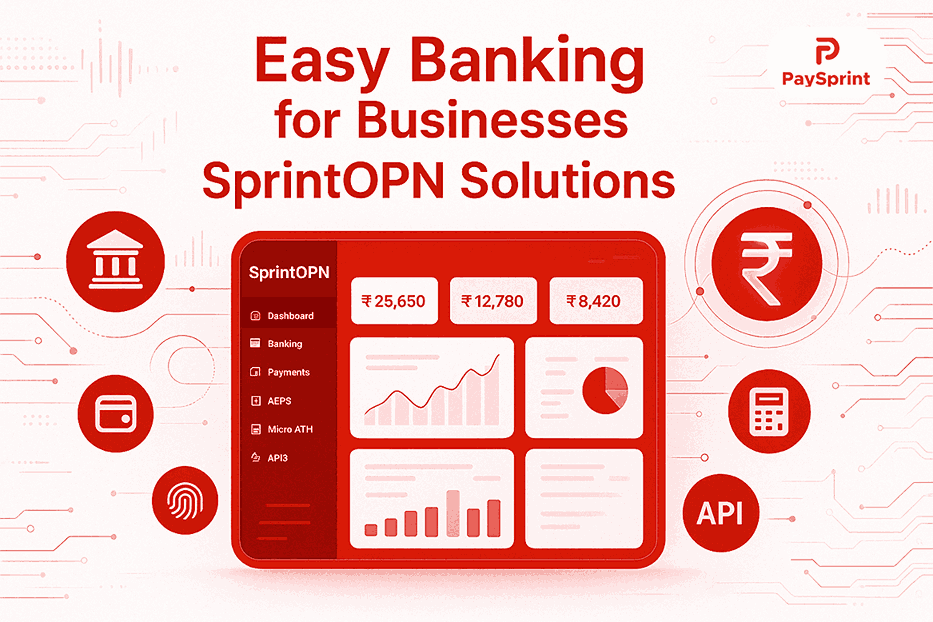

SprintOPN: Easy Banking and Payment Solutions for Businesses

Fintech

Jan 07, 2025

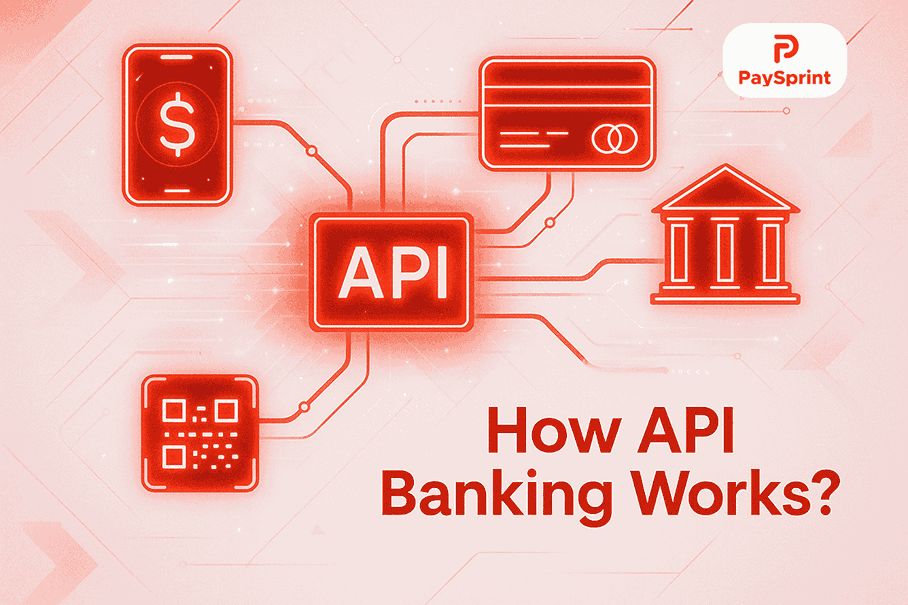

SprintOPN provides innovative open banking solutions to help businesses simplify payments, enhance security, and optimize financial operations with ease.